Can “ITC Next” strategy be an AASHIRVAAD for its Investors?

- Parag Hemdev

- Jan 20, 2022

- 22 min read

Updated: Apr 5, 2022

EVOLUTION | STRATEGIES | BUSINESS POSITIONING

There has been a big debate amongst the investor community with regards to investment in shares of ITC Limited. Some investors are excited & look upon ITC as a stock that has deep intrinsic value & promising future potential, whereas some investors are concerned about its low margin in its FMCG business along with ESG concerns for its cigarette business. Some long-term investors have invested in ITC and are unhappy due to its underperformance in past few years.

Before drawing any conclusion, let us try to analyse how ITC has grown over a period of time, what are the current strengths of the company, the strategies that the management is focusing on, and how its various business segments are performing.

History and Evolution of ITC business:

The evolution of ITC is visible in its growth journey. The company has not only focused on backward & forward integration within its existing business but also diversified into new businesses which have future growth potential.

1910: Incorporation – Cigarette and leaf tobacco

ITC was incorporated on August 24, 1910, under the name Imperial Tobacco Company of India Limited. Primarily the company was engaged in the business of Cigarette and leaf tobacco.

1925: Packaging and Printing - Backward Integration

ITC's Packaging & Printing Business was set up in 1925 as a strategic backward integration for ITC's Cigarettes business.

1975: Entry into the Hospitality Sector

In 1975, the company launched its Hospitality business with the acquisition of a hotel in Chennai. The objective of ITC's entry into the hotels business was rooted in the concept of creating value for a Nation with the intent to earn high levels of foreign exchange, create tourism infrastructure and generate large-scale direct and indirect employment.

1979: Paperboards & Specialty Papers - Development of a Backward Area

In 1979, ITC entered the Paperboards business by promoting ITC Bhadrachalam Paperboards Limited, with an objective to source paperboards for its Cigarette business and development of Sarapaka, an economically backward area in the state of Andhra Pradesh.

1990: Paperboards & Specialty Papers - Consolidation and Expansion

In 1990, ITC acquired Tribeni Tissues Limited, a specialty paper manufacturing company and a major supplier of tissue paper to the cigarette industry. TTD was merged with the Bhadrachalam Paperboards Division in 2002.

1990: Agri-Business - Strengthening Farmer Linkages

In 1990, leveraging its agri-sourcing competency, ITC set up the Agri-Business Division for export of agri-commodities. ITC began its e-Choupal initiative in 2000 with soya farmers in Madhya Pradesh. Now it caters to a variety of crops covering 22 states and benefiting over 4 million farmers. ITC’s e-Choupal initiative has not only increased the yield, income & productivity of farmers but has also strengthened their relation with farmers for sourcing its Cigarette, Paper, FMCG, and Agri-business.

2000: Information Technology

In 2000, ITC spun off its IT business into a wholly-owned subsidiary, ITC Infotech India Limited, to more aggressively pursue emerging opportunities in this area.

2001: Branded Packaged Foods - Delighting Millions of Households

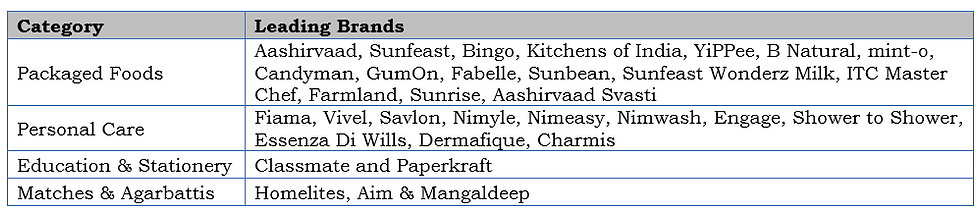

With the experience of its Hospitality business and understanding of the culinary, taste & preferences of its customers, ITC introduced 'Kitchens of India' ready-to-eat Indian gourmet dishes in 2001. In just over a decade and a half, the FMCG foods business has grown to a significant size under numerous distinctive brands which include:

2002: Education & Stationery Products - Offering the Greenest products

With its experience in the Paper & Paperboard segment, ITC launched the Paperkraft brand in 2002. Paperkraft caters to the stationery and office consumables segment. To augment its offering and to reach a wider student population, the Classmate range of notebooks was launched in 2003. Between 2007-2009 company launched practical books, drawing books, geometry boxes, pens & pencils under the Classmate brand.

2002: Agarbattis & Safety Matches - Supporting the Small and Cottage Sector

ITC now markets popular safety matches brands like iKno, Mangaldeep & Aim. The company introduced Agarbattis (incense sticks) under the brand Mangaldeep in 2003 in partnership with the cottage sector.

2005: Personal Care Products - Expert Solutions for Discerning Consumers

ITC started its personal care products division in 2005, over a period company has launched & acquired various brands & products which include:

Future Corporate Strategy

The current management has devised the future corporate strategy “ITC NEXT” with an intent to create a long-term value creation, which focuses on being Future Ready, being Consumer-Centric, and being Agile. “ITC NEXT” strategy is based on the following 6 pillars.

1. Multiple Drivers of Growth

The management highlighted that the company enjoys agri sourcing expertise due to its deep-rooted existing relations with the farmers, packaging knowhow because of its Paper and Packaging division, cuisine expertise and understanding of consumer’s taste & preferences led by its Hospitality and FMCG division, with focus on R&D, data analytics and distribution strength enables the company in acceleration of new launches.

The management is targeting at synergising ITC’s institutional and digital strengths to deliver products that have deeper market opportunities.

2. Innovation and R&D

ITC's state-of-the-art Life Sciences and Technology Centre (LSTC) in Bengaluru is at the core of driving science-led product innovation to support and build ITC's portfolio of world-class products and brands. With 350 highly qualified scientists, agile & purposeful innovations and capabilities of partnerships with global R&D centers, ITC has been able to launch many products in a short span.

The management is focusing on leveraging its R&D efforts for creating long-term sustainable advantage through innovation & differentiated products.

3. Cost Optimization

The management is targeting on removing, reducing & reengineering its cost and on increasing its productivity by improving its processes and implementing digital strategies across the organization.

4. Sustainability 4.0

ITC has taken various initiatives for rural development through its flagship program ITC e-Choupal. Programmes such as “Baareh Mahine Hariyali”, “More Crop per Drop”, ITC’s Rural Education Programme, Livestock Development initiative has increased the income, efficiency & knowledge of best farm practices along with providing market access for the produce.

Initiatives for protecting and sustaining the environment with its programmes like rainwater harvesting, climate-smart agriculture, waste disposal mechanisms, green infrastructure, waste land conversion, agro forestry have displayed the company’s effort towards maintaining bio diversity. ITC has emphasized on social welfare programmes focusing on women empowerment, sanitation etc.

These initiatives have led the company to achieve milestones such as:

ITC commands the highest MSCI ratings amongst global tobacco majors

Some of the key recognition of ITC’s sustainability performance:

1. ITC has been rated AA every year since 2018 by MSCI-ESG.

2. ITC has been included in the Dow Jones Sustainability Emerging Markets Index.

3. Rated at the ‘Leadership Level’ by CDP with scores of ‘A-‘ for both Climate Change and Water Security.

The company is channelizing its efforts on raising the bar with its ‘Sustainability 2.0’ initiative. Management emphasized their vision of ‘Responsible Competitiveness’ by focusing on:

Growth that is extremely competitive and agile

Growth that protects and nourishes the environment

Growth that supports livelihood generation

The management has set the above bold agenda, which it aims to achieve by 2030.

5. Digital

Adoption of digital technology is at the core of ‘ITC NEXT’ strategy. The management highlighted that digital technology/platforms are not only for financial transactions, but are also an important tool for customer engagement. ITC’s e-commerce share for overall business is 7%, and 14% for the Personal Care category.

Over the years, ITC has launched various apps and programs to evolve itself as a digital future tech enterprise.

Emphasizing on the potential of digital technology, management has designed ITC’s Future-Tech enterprise based on 6 pillars

1. New Age Insights:

With its ongoing initiatives such as Sixth Sense, ITC IRIS, Connect, ITC has advanced intelligent in-house data analytics program which helps to get insights of consumer journeys, trends, social conversations, and image analytics that assist the company to identify new products as per consumer preferences and design the content for customer engagement.

2. Reimagined Consumer Experience:

Management headlined that continuous tracking of consumer preferences has given them an edge to innovate products. By capturing consumer data & insights, focusing on R&D, agile manufacturing capabilities and distribution strength, ITC has been able to launch 120 + new products in 2020-21 & 40+ till date fueling its speed & scale of innovation. Many products are in pipeline and would be launched over a period of time. ITC is developing Savlon Nasal Spray. This breakthrough innovation is in the final phase of clinical testing.

3. Smart Operation:

Company has been able to capture demand through its Apps powered by big data analytics like VAJRA – Salesman, VISTAAR – Rural App, VIRU – Virtual Salesman, eB2B – UNNATI and B2C website ITCstore.in.

Management is strengthening its operations by implementing smart robotic in manufacturing process, smart sourcing, agile supply chain management, digitized fulfillment and synchronized planning through its apps & internal programs.

4. Transforming Employee Experiences:

Management is targeting to improve transparent and efficient workflow processes within its departments and business segments by implementing digital initiatives across the organization.

5. Skills, Culture & Work Designs:

Management highlighted the need to promote and develop digital skills and culture for its human capital, to be a future ready enterprise by implementing various strategies at all levels.

6. Business Model Transformation: Platform | D2C

The company launched its D2C platform ITCstore.in last year to provide a best-in-class buying experience to customers. The company is also focusing on launching a few Digital First Brands.

The management emphasizes the need for powering synergies across the value chain through technology driven robust analytical platform guiding business decisions.

6. World Class Talent

ITC’s management is focusing on building a ‘Proneurial’ spirit for its human resources which are aligned with its organizational goal and are engaged in innovation & growth.

Let’s look at a comprehensive overview of each of ITC’s businesses and key takeaways from the management.

1. FMCG Cigarettes Business Overview

ITC is a leader in organised domestic cigarette industry with ~80% market share. In FY2021, the cigarette segment contributed ~38% of the total revenues and 85% of its total EBIT.

ITC has built its cigarette business on four key strategic levers:

1. Future ready portfolio:

ITC has a strong & vibrant portfolio with leading brands in every market segment catering to various price points.

➤ Classic Brand is 40+ years in the market yet vibrant & contemporary, 4 new variants launched over the last 5 years which contribute to ~25 % of the portfolio.

➤ Gold Flake is over 100 years of legacy and trust, New launches in the last 5 years account for 10% of the Portfolio, 10+ new launches in the last 18 months – Rapid diversification into new segments.

➤ The portfolio continues to evolve, 11% of volumes come from new products.

➤ Products assortment more than doubled in last 8 years

2. Agile innovation:

Company is focusing on R&D with cutting edge capability of 80 scientists, 20 granted patents and ~60 more in progress. By using its leading R&D capabilities, company is able to offer different products.

3. Integrated ‘seed-to-smoke’ value chain:

ITC’s procurement, manufacturing and packaging capabilities allow it to capture value at every stage. ITC has integrated in-house capability for leaf development, capsules & specialty filters. Very few companies in the world have such capabilities.

4. Excellence in execution:

ITC’s products are available in 7.1 Mn category outlets which are > 2x nearest competitor and are a leading brand in every market segment.

Management highlights:

➤ Management highlighted that legal cigarettes in India account for only 8% of total tobacco consumption and rest 92% comprises other forms of tobacco consumption, including smoking (Bidi and Illicit cigarettes) and smokeless (Chaini, Zarda, Gutkha). Even though legal cigarettes are ~ 8% of total tobacco consumption it contributes to ~80% of government tobacco tax revenue.

➤ The legal cigarette industry is impacted by a sharp increase in tax incidence over the years and India is the fourth largest illicit cigarette market.

➤ Management tried to allay concerns about higher taxation on its mainstay cigarettes business, by giving the below data of how cigarette revenue grew during periods of tax stability.

➤ By considering the above factors management expects a rational decision by the government and any increase in taxation to be well spaced out in any case.

➤ ITC expects to gain market share due to its diverse product profile, wide distribution network, integrated seed to smoke value chain and government action on illicit cigarette trades given the taxation remain stable.

2. FMCG Other Business Overview

ITC has 25+ mother brands spread across multiple FMCG sectors. With annual consumer spends of ~22,000 crore.

ITC is 2nd Largest FMCG listed player in India.

FMCG business grew at 12.7% CAGR in 10 years vs. FMCG Comp Set at 10.3%. Revenue has grown 4x (3,642 crore in FY2010 to 14,728 crore in FY2021)

In FY2021, FMCG other segment contributed ~27% of the total revenues and 5.6% of its total EBIT.

Addressable Market Expansion Potential with in the FMCG category

The above table highlights the addressable market opportunity within Food and Personal Care categories.

Management Highlights:

➤ Management drew attention to branded packaged foods in India which is poised to grow and has huge future growth potential. Branded packaged F&B commands 15% market share compared to 85% by Unbranded F&B.

➤ The Company expects the branded packaged F&B consumption could increase multifold, due to low penetration and rising consumer trends for safer and hygienic products, convenience, rising disposable income and digital penetration. Government of India initiatives of production linked incentives (PLI) and sector outlay of INR 10,500 crores. ITC is the largest investor in PLI for foods, Ready to Eat & marine space. The company would be focusing on exports of FMCG products in different countries.

➤ ITC shall also focus on inorganic way to grow, after seeing a positive synergy from its recent acquisitions like Savlon, Nimyle and Sunrise.

➤ ITC is looking at new market routes like direct marketing, QSR chains, strategic partnerships, climate-controlled supply chain and scaling up food services.

➤ Export has accelerated not only in Aashirvvad Atta but also in other packaged foods brands like Yippee and Sunfeast with the help of PLI supportive scheme.

➤ In the next three years company would spend 35% to 40% of capex towards FMCG capacity expansion.

➤ FMCG segment EBITDA margin grew from 2.5% in FY2017 to 8.9% in FY2021

➤ Management headlined that though it is witnessing unprecedented inflation in edible oil, palm oil & packaging, it has been able to sustain 9 percent EBITDA margins in the first half of FY22.

ITC Food Business

ITC food business is built with purpose to "Help India Eat Better". Company demonstrate this by offering great quality products & exciting innovations that are science-based & as per consumer preferences.

➤ Four ITC Food brands are amongst the top 20 trusted food brands in India with a presence in over 20 food categories.

➤ ITC Food brands are present in 56.3Lakhs (>50%) stores across the country.

➤ One in Two Indian households use ITC products. ITC Foods brands are present in 17.4cr households.

➤ Net revenue for FMCG Food segment grew 16% CAGR in 10 years, growth of 4.2x.

➤Global footprint extended to 58 countries and export revenue grew 2x from FY2018 to FY2021.

Four Key Power Brands Highlights:

1. Aashirvaad Atta:

The company in its recent presentation highlighted that organised branded Atta category commands 14% to 15% market share, wherein their Aashirvaad Atta brand commands >50% market share.

2. Sunfeast Cream Biscuits:

Company commands 26% market share in the premium biscuits segment which is 1.5X times, the largest competitor in biscuits.

3. Bingo:

4. YiPPee:

Management has targeted 3 comprehensive strategies to win the market

(I) Consumer Centric Innovation

The company is focusing on products innovation by keeping the consumers at the center.

The company is able to understand the customer better by identifying microtrends, consumer needs, desire, customers, and problems thereby assisting the company to develop new products ideas & propositions. Consumer Insight helps the company to collect real-time data. Traditionally data was sourced from market research, now it’s available on a real-time basis by tracking of consumer conversations 24X7 on social media, customer care feedback, e-commerce rating, media impressions etc.

Company is utilising cutting edge digital tools & techniques to connect with the consumers by in-house content creation, deployment of content, using AI-based diagnostic tool for evaluation, etc.

ITC’s focus on consumer centric innovation can be understood by its new launches of products in varied consumer trend like:

Convenience: To aid in-home cooking and to enhance homemade meal experience during pandemic company launched ITC Pastes & Gravies, Instant Meals and Frozen Foods under its ITC MasterChef brand.

Health: Catering to long term consumer trend of health and awareness of organic foods, company launched Aashirvaad Nature’s Super Foods which include organic Atta and Pulses, Gluten free flour, Ragi flour, Multi millet mix. Aashirvaad Salt Proactive for better heart health. Yippee whole wheat noodles with vegetables infused, Farmlite veda digestive biscuits etc.

Immunity & Safety: During the beginning of Covid-19 ITC launched many categories of foods products for immunity and safety like B Natural Mixed Fruit+, Orange+ with clinically proven ingredient, Veda Marie light, Aashirvaad Svasti Cow Ghee/Milk.

First to market products: ITC was first to market products such as 100% Pomegranate Juice, Round Noodles, Tri Colour Pasta, Unique Products in Frozen Segment, Saucy Noodles, Multi Millet Mix, Squeeze-It bottle for Ghee etc.

Regional taste and preferences: ITC has developed different blends of Atta within its Aashirvaad brand for Rajasthan vs Punjab and other Northern states as per customers taste and preferences.

(II) Strengthening the Core

The company is strengthening its core brands by focusing on below four pillars.

Launching Range/Value Added Products:

Company proposes to position itself as a preferred bakery brand in India and expanding its Sunfeast brand catering to adults, homemakers, youth and teens by offering biscuits, cakes etc. For instance, within the Sunfeast brand the company has sub brands like, Sunfeast Dark Fantasy which caters to premium biscuits, Sunfeast allrounder caters to potato chips biscuits, the Sunfeast Caker caters to ready to eat on the move cake, Sunfeast Bounce caters to affordable cream biscuits segment, Sunfeast Farmlite and Marielite which caters to health-conscious customers. Sunfeast Moms Magic caters to the cookies segment. Similarly, it has launched various products under its other mother brands.

Leverage Power Brands to adjacent categories:

Addressing emerging consumption moments:

Due to a shift in behavioral choice in North India, ITC through its campaign ‘4 Kadam Aage’ is highlighting the process efficiency of Aashirvaad Atta, so that it can convert the wheat & loose atta buyers in North India.

Similarly, to increase the consumption of the wheat Atta category in South India, ITC has started communicating “Versatility of Atta” by educating consumers with Atta recipes.

Extending into Newer / Alternate channels:

For better convenience and accessibility of its products the company has partnered with B2B E-commerce giants like Amazon, Reliance Retail, Bigbasket, Swiggy etc. The company’s products command top ranking position in modern trade and e-commerce. Products are also available in traditional retail channels serving 56.3 lakhs outlets.

ITC has B2B institutional partnership with Domino’s, McDonald's, Spicejet, IndiGo and Amway for its B Natural Juice brand. Company has also partnered with Inox under its Kitchens of India brand to supply ready to eat meals to cinema patrons.

ITC launched its own D2C portal, (www.ITCstore.in) wherein it supplies more than 500 products on its website.

(III) Driving Profitability

The company highlighted that it is driving profitability through the following strategies:

Smart Manufacturing & Agile Cost Management:

Company has integrated ICML facilities across 9 food categories like atta, noodles, biscuits, snacks, juices, etc. at scale, which helps them in supply chain optimization, products freshness by reducing the distance to market, shared infrastructure and reduction of overhead.

The company enjoys flexibility in its manufacturing process as the same set of machines with minor modification can be used for making pasta, vermicelli, and chips depending upon its product demand and seasonality.

The company not only sources wheat from its Agri division for Ashirvaad Atta but also for other product categories such as Yippee, Sunfeast, etc. giving them economies of scale in procurement.

Agile cost management has resulted in cost efficiencies and an increase in productivity.

Portfolio Premiumization:

ITC is focusing to extend its core brand namely Aashirvaad Atta and move towards premiumization beyond atta for better margins by bringing relevant cooking solutions for the homemaker like Aashirvaad Salt, exclusive quality of spices, ready to eat/cook breakfast solutions like rice idli, rava idli, rice dosa and vermicelli, gluten free flour, ragi, multi millet mix, organic dal & pulses, sugar release control atta for health & wellness conscious customers under its Aashirvaad Nature’s Super Foods. ITC is also expanding its product portfolio in dairy products like dahi, lassi, paneer, mishti doi into the newer market like Bihar on a pilot basis.

Value Accretive acquisition:

The management emphasized that historically the company has grown mainly organically. The company could also focus on acquiring the brands through M&A like in the case of Sunrise pure.

Sunrise Pure is a 70-year-old brand and No.1 brand in West Bengal in spices. ITC would drive future growth for Sunrise by maintaining moment in ongoing business, driving new distribution points through E-commerce & Modern Trade, expanding other markets of the east, and unlocking digital presence to reach out non-Bengali audiences.

Personal Care Business:

ITC recorded 19% topline CAGR in Personal Care business during FY2017 to FY2021. Some of the leading brands in personal care are:

Savlon: Leading player in Health & Hygiene, a leader in disinfectants.

Fiama: No 2 all India in body wash.

Vivel: Regional leader in category (No 1 in Assam & North East No 2 in WB & Orissa in mid popular segment).

Engage: No.2 in Category.

The company’s future strategic levers are based on five pillars

1. Building Brands with Purpose

The company drew attention to building a connection with the consumer with a purpose.

2. First in Category Innovations

ITC has launched first in category innovative products such as:

The below table highlights the penetration and ITC’s ranking in future facing categories.

3. Drive Growth in Focus Category

The penetration of liquid soap as compared to bar soap is quite low in India which is reflected in the above chart.

In India, there is a myth that liquid wash is comparatively expensive to soap and it needs loofah. Price is an important factor in India and is equated by the price per wash equation. Management through its campaigns tried to demonstrate that ITC’s body washes and hand washes have cost per wash similar to soaps, enabling faster penetration.

ITC is growing faster than the industry in liquid personal wash. Industry growth in liquid personal wash was 14.3% from Sept 2019 to Sept 2021. Whereas ITC’s growth in the said category was 27.6% from Sept 2019 to Sept 2021. Also, liquid as a % of total personal wash for ITC stands at 25.5% in Sept 2021 compared to 14.7% in Sept 2019 and has more margins as compared to soap bars.

4. Winning in Channels of the Future

With the strategic partnership in modern trade with e-commerce websites and its own D2C website, ITC’s sales for PCPBD (Personal Care Products Business Division) has grown double-digit compared to the FMCG industry average growth of 2.3%. The company is also looking to launch a few Digital First Brand for a few of its products.

5. Value Accretive acquisition

Initially, the company had grown organically with its brands like Vivel, Fiama, Superia, Engage, etc. Realising the success of its acquisitions of its inorganic brands such as Savlon and Nimyle the company is open for value accretive acquisitions.

Savlon:

Savlon became INR 1000 cr. brand in 6 yrs. post-acquisition in 2015 and revenue has grown 14x from FY2015 to FY2021.

Management drew attention to the strengths of the Savlon brand. Although the brand had 50 years of heritage in India, there existed a big gap in performance equity with the lead competition. However, company has been able to build Savlon’s performance equity by repositioning itself as, “Doctors most trusted” brand.

During Covid-19 ITC was on a rapid pace of Innovation, they launched many product ranges in the Savlon brand.

3. Hotel Business Overview

ITC Hotels is the second-largest hotel chain in India, With 110 hotels at 75+ locations and 10,200+ rooms. Its hotels are classified under 6 distinctive brands:

In FY2021, the Hotel business segment contributed ~1% of the total revenues and had a negative EBIT margin due to covid-19.

➤ The largest chain of hotels in the world, with maximum LEED® Platinum Certified Properties’, as per USGBC.

➤ ITC Windsor, the first hotel in the world to achieve LEED zero carbon certification.

➤World’s 1st hotel chain - Platinum certification in infection risk management by M/s DNV

Management Highlights:

➤ The company is focusing on Asset Right Model by adding its footprint through management contracts under the brands such as Welcomhotel, Storii, and Mementos.

➤ The company is also focusing to leverage on its digital technology for Guest servicing and Loyalty programmes.

➤ Management said that inbound travel has increased due to restrictions on outbound travel and the company expects the trend in inbound travel to stay for a longer period of time.

➤ The plan to create an alternative structure for the hotels business has not been postponed the long term and will be done as the industry recovers.

4. Agri Business Overview

Agri business is a backbone of ITC’s all divisions like Cigarette, FMCG food, Paper & Paperboard, etc. which sources high quality & cost-competitive agri commodity from farmers for its divisions. It enjoys a deep-rooted relationship with farmers through its e-Choupal initiatives which ensures a smooth supply of farm produces for its distinctive brands. For instance, sourcing & supply operations cover wheat for Aashirvaad atta, Sunfeast biscuits, potato for Bingo, fruit pulp for B Natural, spices for Aashirvaad & Sunrise, milk for Aashirvaad Svasti, supply of bamboo for its paper and packaging business, supply of tobacco for its cigarette business, etc.

ITC's Agri Business is the country's second-largest exporter of Agri-products. It currently focuses on exports and domestic trading of:

ITC is one of India’s largest buyer, processor, consumer & exporter of cigarette tobacco. It is a 5th largest leaf tobacco exporter in the world with 40% of total Indian exports.

In FY2021, the Agri business segment contributed ~23% of the total revenues and 5.5% of its total EBIT.

Management Highlights:

➤ For margin improvement company would focus on value-added ingredients & niche products like spices, fruits & vegetables and processed products like certified coffee, aqua, attribute based maida and organic cereals.

➤ ITC MAARS - Transformative business model building on e-Choupal 4.0 to launch in next few months, which would be hyperlocal solutions for input/output markets.

ITC-MAARS will give ITC e-Choupal new wings and create a robust ‘Phygital & Digital' eco-system.

Physical solution is anchored by FPOs (farmer produce organizations), which generates new revenue streams, improving sourcing efficiencies and powering ITC's world-class Indian brands.

ITC-MAARS will provide a wide range of agricultural solutions, with its digital framework allowing a variety of agri-tech solutions. Hyperlocal services, AI-based customized advice and online markets will make up the whole package.

5. Paperboards, Paper & Packaging Business

ITC’s paperboards and specialty papers division is India’s largest, technologically advanced, and most eco-friendly paper & paperboard business. This division was set up as a strategic backward integration for ITC's Cigarettes business. It is today India's most sophisticated packaging house.

In FY2021, the Paperboards, Paper & Packaging business segment contributed ~10% of the total revenues and 7.4% of its total EBIT.

ITC's Paperboards and Specialty Paper Business is the leader in volume, product range, market reach and environmental performance.

Paper and Paperboard segments caters to large cross-section of industry requirements - from cigarette papers and Components to FMCG cartons, from electrical insulation papers to Bio-based Barrier Coated Board, from decorative laminate base to writing and printing papers and much more.

Its clientele includes several well-known domestic and international companies such as Tata Consumer, Hindustan Unilever, Nestle, GSK, Colgate, P&G, British American Tobacco, Japan Tobacco International, Agio Cigars, Surya Nepal, Pernod Ricard, Diageo, Foxconn, Flextronics, Burger King, Royal Enfield, etc.

ITC straddles the entire spectrum of paperboards - from 100% virgin, food-grade boards which are made from renewable and sustainable sources to 100% recycled boards.

Management Highlights:

Across the world, paper is made from soft wood pulp. Since, India doesn’t have soft wood. So, ITC invested in innovative technologies to convert hard wood into soft-wood pulp. There has been a significant improvement in margin due to the above intervention.

6. ITC Infotech

ITC Infotech is a 100 percent owned subsidiary. The company provides technology solutions and services to enterprises across industries such as Banking & Financial Services, Healthcare, Manufacturing, Consumer Goods, Travel and Hospitality, through a combination of traditional and newer business models, as a long-term sustainable partner.

In FY2021, the ITC Infotech business segment contributed ~4% of its total revenues and 3.4% of its total EBIT.

Other key takeaways:

Dividend Policy:

The company would continue to maintain 80-85% dividend payout and would prefer maintaining ordinary dividends instead of giving special dividends.

Capex Plan:

The management has guided that it would undertake capex of around Rs 10,000 crore over the next three years, of which 35-40 percent would go towards FMCG capacity expansion, while 25-30 percent towards ITC Paperboards. About 10 percent of the capital would be spent on completing its major hotel projects and the rest of the sum on building digital capabilities.

Demerger:

In connection to its Demerger plan the management has not given any concrete plan for demerger and listing of businesses to unlock value. Management headlined that company’s strategy has always been to leverage its institutional strengths and synergies, which have driven growth for the FMCG business. Management said the business undergoes periodic reviews and did not rule out any of the options. Management is open to seeing what is right to create long term sustained value for its shareholders and these are things it evaluates from time to time.

Conclusion:

Comments